Get the funds you need to stock inventory and reach more buyers on Ovoko - no collateral, no hassle, just growth.

Our sellers often need to stock more parts to meet demand. Softloans makes it easy to finance that growth without tying up working capital.

Key benefits for Ovoko merchants

No collateral

Keep your assets safe. Financing based on your sales, not property.

One clear fee

Simple, transparent pricing. No hidden charges, no surprises.

No schedules

Repay a percentage of your sales - slower days mean smaller repayments.

Fast & Easy

Apply in 10 minutes. Get an offer within 24 hours, fully online.

Repayments that move with you

How does it work?

Share your details

Fill in a simple form with your business and contact information.

Connect your accounts

Make quick sales and bank integrations - fully digital, no paperwork.

Get your offer in 24 hours

Receive a tailored financing offer and invest in your growth with Ovoko.

FAQ

Who can receive revenue-based financing?

Businesses are welcome to apply for financing if they have been in business for more than 6 months and generate at least 3000 EUR in average monthly revenue through online sales or sales processed via POS terminals.

What is the cost of revenue based financing?

The offer depends specifically on your business performance data. We invite you to complete our short digital application - takes only 10 minutes - and receive your personalized offer in 24 hours.

Here is a generic cost structure:

Once you accept an offer, a fixed loan fee is charged. This usually starts at 12% of the

financing amount. There are no other fees.

A typical example:

-

Amount of funding - 9000 EUR.

-

Loan term - up to 12 months.

-

One-time fixed fee - 12% (1080 EUR).

-

Interest rate - 0%.

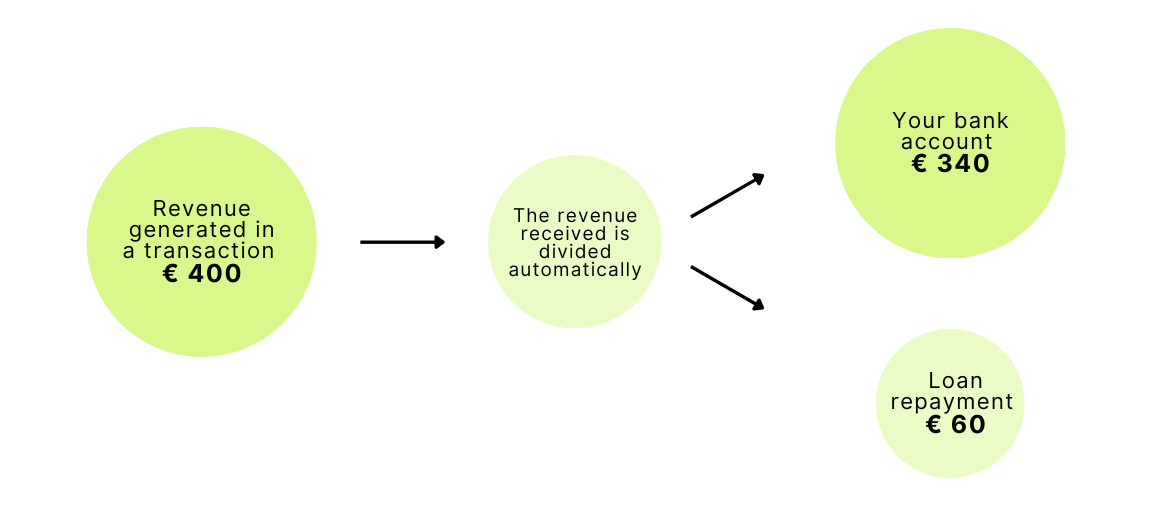

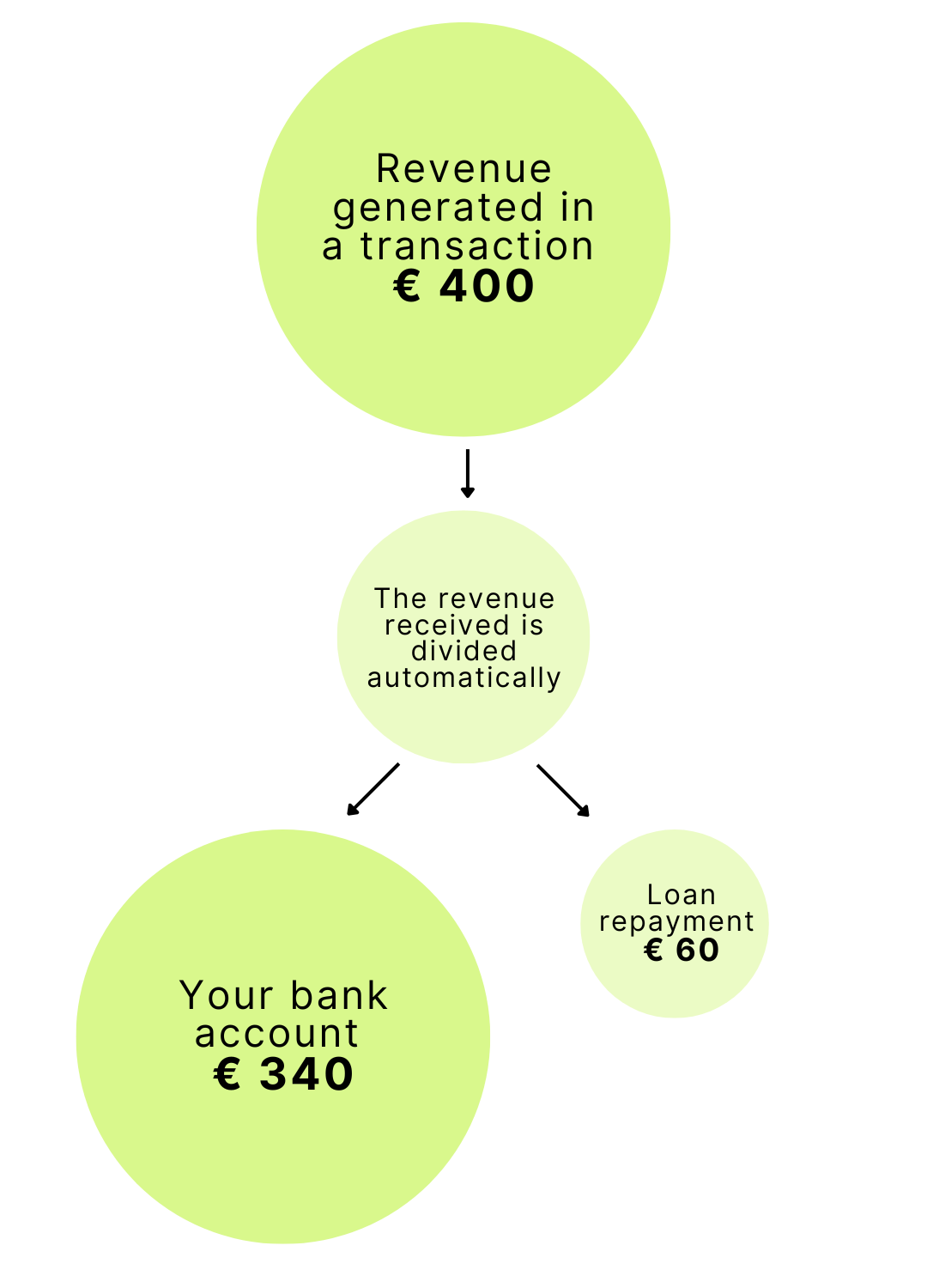

Repayment schedule - 15% of incoming revenue is used for loan repayment.

How is revenue-based financing different from other forms of business financing?

In revenue-based financing, interest payments are replaced with a fixed one-time fee. No other fees the cost of money is clear.

Instead of a fixed repayment schedule, the client uses an agreed percentage of their incoming revenue for loan repayment until the provided funds are fully repaid. Repayments naturally adapt to the heartbeat of your business. When business slows down, so do the repayments.

What is Softloans?

Softloans is a fintech that specializes in technological solutions to help SMEs grow. Softloans does that by providing easy access to working capital.

What is the catch here?

There is no catch. Revenue-based financing is radically transparent - the cost of money is very easy to assess and does not change.